Tax Pro with Experience Working With Billionaires Weighs in on Trump Tax Return

On Friday December 30, 2022 the House Ways and Means Committee released six years of former President Donald Trump’s tax returns. The release of the tax returns offers a rare opportunity to gain insight into tax strategies used by the most wealthy people in the United States.

Holding Companies and Trusts

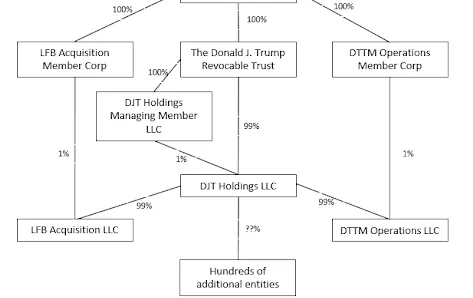

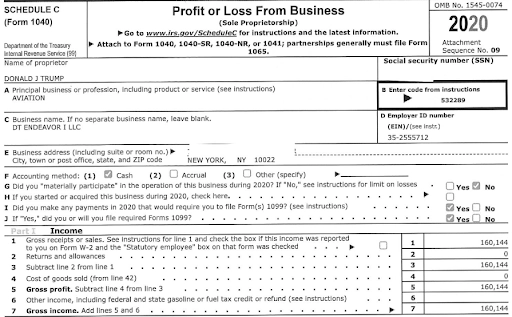

The entity structure of Mr. Trump’s organization is sophisticated to say the least. Mr. Trump strategically uses trusts and holding companies to organize and control his business interests.

At the pinnacle of his entity structure, Mr. Trump uses a revocable trust, The Donald J. Trump Revocable Trust. The revocable trust provides a way to ensure that the business interests owned by Mr. Trump can continue to operate without interruption should the grantor, Mr. Trump, become incapacitated. From the information available, it cannot be determined who the trustee of the trust is. For the ultra wealthy, it is not uncommon to establish a Private Trust Company (PTC) to serve as the trustee for trusts.

Mr. Trump also uses holding companies to control his business interests. A holding company is a parent company of a subsidiary company. Holding company structures are routinely used by large corporations and wealthy families primarily to consolidate control and limit liability of each business interest. It appears that the primary holding company for Mr. Trump is DJT Holdings LLC. DJT Holdings LLC owns interests in hundreds of subsidiary entities including LFB Acquisition LLC and DTTM Operations LLC. Mr. Trump and his revocable trust are the ultimate beneficial owners of the holding company and subsidiaries.

Passthrough and Disregarded Entities

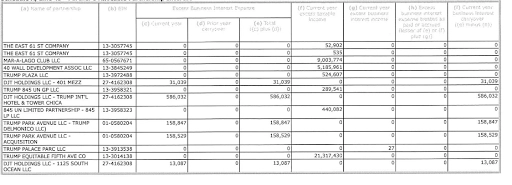

In total, Mr. Trump has interests in over 400 entities, most of which are structured as passthrough and disregarded entities. Passthrough and disregarded entities, unlike corporations, do not pay federal income tax. The income, deductions gains, losses, and credits from passthrough and disregarded entities are reported directly on Mr. Trump’s individual tax return. The use of passthrough entities generally allows individuals to offset income from one entity with losses from another entity, which would not be possible if the entities were all organized as corporations.

Itemized Deductions

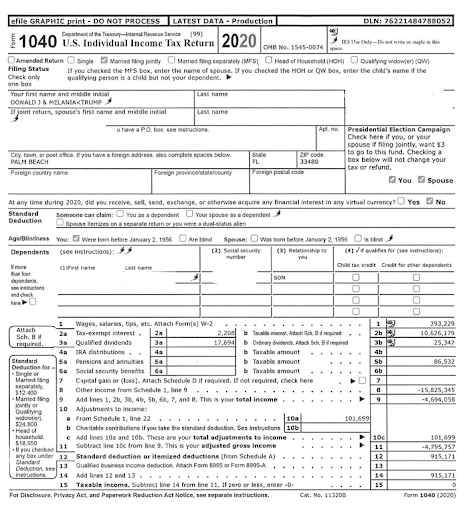

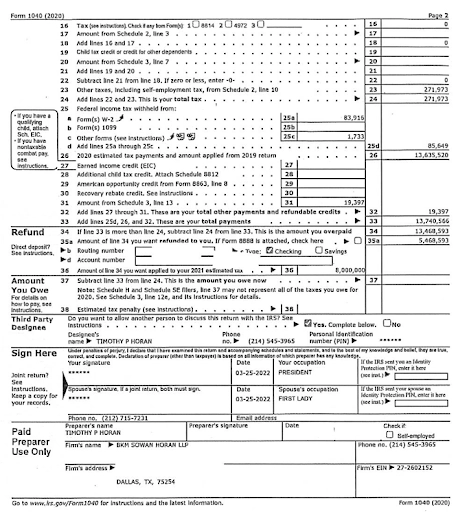

Mr. Trump reported itemized deductions of $915,171 in 2020. This amount consisted of a $896,616 deduction for investment interest expense, $8,555 of other deductions, and $10,000 of state and local income and property taxes.

i. Mr. Trump’s itemized deductions were severely limited by provisions in the Tax Cuts and Jobs Act that limit the deduction for state and local income and property taxes to $10,000. In 2020, Mr. Trump paid $8,510,551 of state and local income and property taxes (known as SALT) but was entitled to a deduction of only $10,000.

ii. Elective Pass-Through Entity Tax – As of August 31, 2022 over 29 have states have implemented what is commonly referred to as a SALT cap workaround or Elective Pass-Through Entity Tax that effectively allows business owners to circumvent the $10,000 deduction limitation. The PTE election was not as widely available in 2020 as it is today. If qualified and if an appropriate election was made, Mr. Trump would be entitled to an increased tax deduction of over $7 million.

Interest Income

Mr. Trump reported interest income of $10,626,179 in 2020.

iii. Of the $10,626,179, $9,741,811 of interest income was earned by a passthrough entity identified as Hudson Waterfront Associates.

iv. Also of note is the $45,780 collective interest income paid by Ivanka Trump, Donald J. Trump Jr., and Eric Trump. Wealthy families making loans to their family members is a common tax strategy. However, it is imperative that appropriate and timely interest payments are made on the loan to avoid the IRS considering the loan a gift. Having the loan be deemed a gift would cause unintended tax consequences.

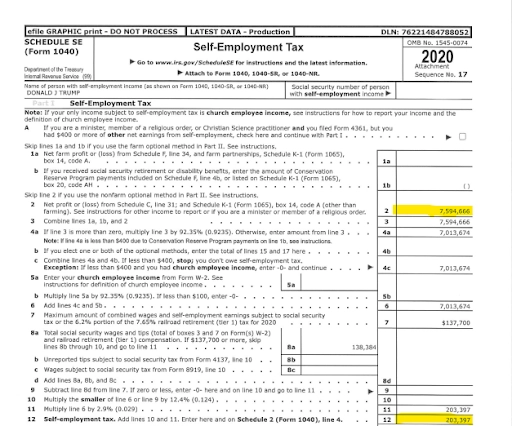

Self Employment Tax

Mr. Trump paid $203,397 of self employment tax on $7,594,666 of business income. Even though Mr. Trump reported negative taxable income for the 2020 tax year, he was still subject to self employment tax on his business income. The source of the self employment tax is not clear from the information available, but it can be reasonably inferred that his passthrough and disregarded entities are generating self employment income.

Income and Loss From Rental Real Estate, Royalties, Partnerships, S Corporations, Estates, and Trusts

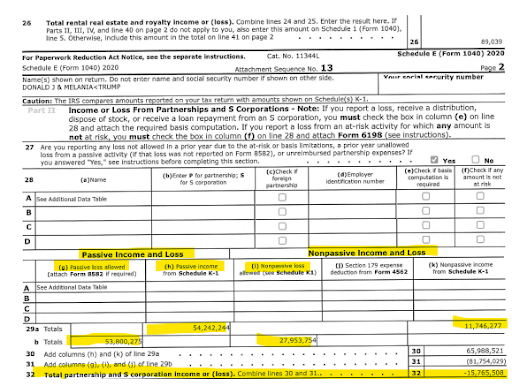

As mentioned, Mr. Trump utilizes passthrough entities and disregarded entities, as such, most of his income and losses are reported on Schedule E. Since Mr. Trump has so many business interests in varying industries and geographic locations, it can be presumed that careful consideration was taken to determine which businesses Mr. Trump materially participated in.

v. Passive versus nonpassive income

i. A taxpayer can generally deduct losses from their business if they are deemed to materially participate in the trade or business. If the taxpayer does not materially participate in the business, their income is deemed passive and losses are disallowed until passive income is generated. The material participation test is applied on an activity by activity basis. It can be reasonably inferred that since Mr. Trump owns an interest in over 400 businesses, he would need to spend over 200,000 hours each year to deduct all losses incurred by his businesses. As shown on Mr. Trumps Schedule E, he listed the entities that he considered himself a passive owner of and suspended the losses from those entities. Mr. Trump has over $16 million of passive losses suspended and available for use against future passive income.

ii. In addition, an election known as a grouping election can be made to group one or more businesses as one for purposes of meeting the material participation test. It can be inferred that a grouping election was filed by Mr. Trump so that he could meet the hour requirement for material participation.

iii. The entities that Mr. Trump identified as material participation entities include Mar-A-Lago LLC, The Trump Corporation, Trump International Golf Club LLC, 401 Mezz Venture, and LFB Acquisition LLC. The income and losses from these entities are fully allowed and not subject to passive activity loss limitations.

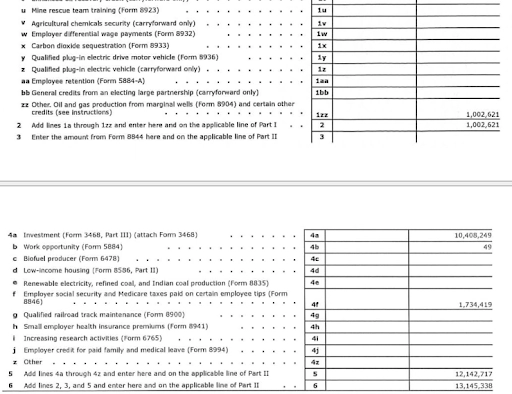

Tax Credits

Mr. Trump has reported a total $13,145,338 of tax credits on his 2020 personal tax return. The majority of these claimed tax credits were incurred in prior years and have been carried forward for use in future years, because Mr. Trump has not yet met the thresholds to take these credits.

iv. Oil and gas production from marginal wells tax credit of $1,002,621

v. Rehabilitation Investment tax credit of $10,408,249

vi. Employer social security and Medicare taxes paid on certain employee tips credit of $1,734,419

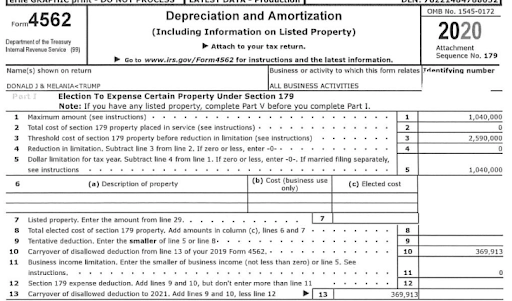

Section 179 Deduction

A common issue encountered with owning a significant number of passthrough disregarded entities is the non-coordination of the 179 deduction. In 2020, the maximum allowed 179 deduction was $1,040,000. If more than the allowed amount of 179 deduction is elected in total by his entities, the excess will be disallowed and carried forward for use in future years. This is what appears to have happened in some year prior to 2020 and generally occurs when tax filing elections are not coordinated among all entities. Mr. Trump has a disallowed 179 deduction carryover of $369,913.

Have Questions About Tax Strategies?

Disallowed Business Interest Deductions:

Since Mr. Trump owns significant real estate holdings, it can be reasonably presumed that the amount of interest expense paid each year is substantial. The actual amount of interest expense paid cannot be determined without reviewing all the tax business tax returns. In general, the deduction for business interest expense paid is disallowed if the entity does not generate enough taxable income. The disallowed business interest expense is then carried forward to future years and available as a deduction once the entity generates sufficient taxable income. Mr. Trump has at least $947,534 of disallowed interest available to be deducted in future years. Most of the disallowed interest expense is related to Trump International Hotel in Chicago. It can be reasonably inferred that Mr. Trump’s interest deduction disallowance will continue to grow if his profit remains the same. The reason for this is that as of January 1, 2022, depreciation, amortization, and depletion are no longer included in the calculation to determine interest expense deductibility. Applying the current changes to Mr. Trump’s DJT Holdings LLC, Mr. Trump would have an additional $1.6 million of disallowed interest expense.

About The Author

Christopher Sternau, CFP®, CPA

Partner – Evans Sternau CPA LLC

https://www.linkedin.com/in/christophersternau/

Christopher Sternau is a Certified Public Accountant and Certified Financial Planner with over a decade of experience providing comprehensive tax and financial planning services to several of the wealthiest families in the United States. He focuses his practice on complex individual and closely held business tax planning and preparation. His clients have business interests in a wide range of industries including oil and gas, mining, real estate, cattle ranching, retail, technology and many others.

Chris is the founding member of Evans Sternau CPA LLC. Prior to founding Evans Sternau CPA LLC, Chris led the tax department for a family office in Houston, Texas. He also spent several years as a Tax Manager at Andersen.

About Evans Sternau CPA

Evans Sternau CPA is seeking reform in an industry where responsiveness and availability are the exceptions – not the norm.

Our global network of committed CPAs and accountants places proactive thinking at the forefront of our work. With robust service offerings and client support strategies, we are always searching for opportunities to serve your best interests.

While our philosophy is rooted in tried and trusted methods, our execution surpasses the norm and redefines the standard.

https://www.linkedin.com/company/evans-sternau-cpa/

832-482-4240

4306 Yoakum Blvd. Suite 460 Houston, TX 77006

9450 Grogans Mill, Suite 145 The Woodlands, TX 77380

Circular 230 Notice – The statements contained herein are not intended to and do not constitute an opinion as to any tax or other matter. They are not intended or written to be used, and may not be relied upon, by you or any other person for the purpose of avoiding penalties that may be imposed under any federal tax law or otherwise.