HSA vs 401k vs FSA: Where to Fund First for Tax Benefits

Wondering if you should fund an HSA or 401k first? Learn how HSA, FSA, and 401(k) accounts compare and how to prioritize them for tax efficiency

Written by: Caleb Johnson

Date of publication: 10.12.2025

Table of Contents

Your paycheck only stretches so far. When you’re staring at your benefits portal, trying to decide between your 401(k), HSA, and FSA, it can feel like a puzzle. This isn’t just a choice between retirement and healthcare. It’s a question of tax strategy today and financial flexibility tomorrow. Getting this right can save you a serious amount of money. This guide breaks down a smart approach to funding HSA vs 401k accounts. If you need help tailoring this strategy to your specific financial situation, our individual tax advisory and preparation services can provide the clarity you need.

Key Takeaways

- Grab the 401(k) match first. Always contribute enough to your 401(k) to get the full employer match – that’s essentially a 100% return on that portion of your contribution.

- Then prioritize maxing your HSA. After the match, your HSA usually comes next because it offers triple tax benefits (pre-tax contributions, tax-free growth, and tax-free withdrawals for medical costs) and can double as a retirement account.

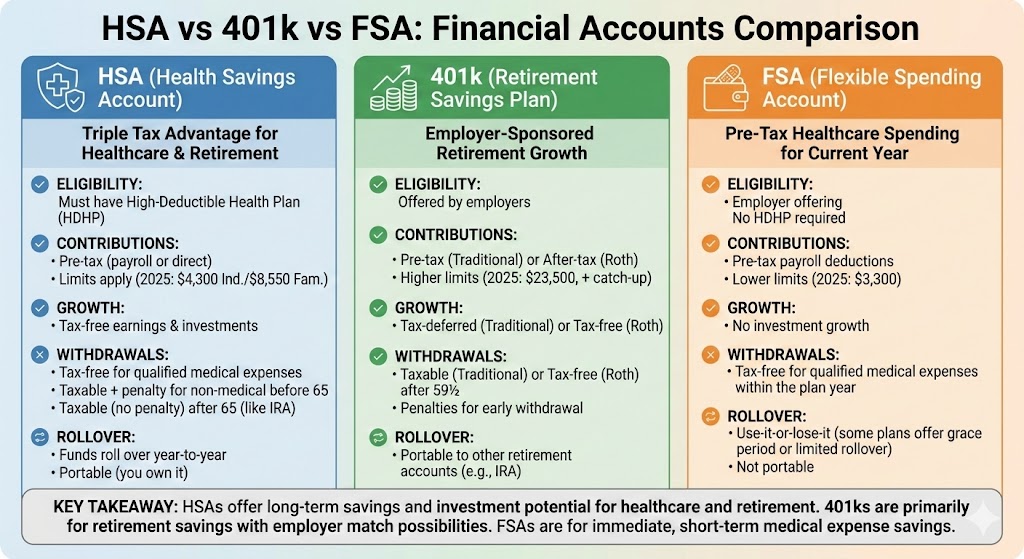

- Understand the key differences: HSA vs FSA vs 401(k). HSAs require a high-deductible health plan and are portable and flexible; FSAs are “use-it-or-lose-it” and don’t follow you to a new job; 401(k)s reduce taxable income now but are fully taxable when you withdraw in retirement.

- FSAs are helpful but risky if you overfund. FSA contributions are pre-tax but must generally be spent within the plan year, so you need to estimate medical costs carefully to avoid forfeiting unused money.

- Your personal situation can change the priority. High expected medical expenses, lack of HSA eligibility, or an unusually generous 401(k) match can shift how much you put into each account in a given year.

- Recheck your strategy every year. During open enrollment, review your health plan, income, and goals, then adjust how much you put into your 401(k), HSA, and FSA so your plan reflects your current life, not last year’s.

Understanding the Accounts & Their Tax Features

To qualify for a Health Savings Account (HSA), you need to be on a high-deductible health plan. Once you’re in, the tax benefits are hard to beat. You fund it with pre-tax dollars, the balance grows without being nibbled by taxes each year, and you can pull money out for doctor’s bills or prescriptions completely tax-free. These features make the HSA a powerful vehicle for those looking to minimize tax liability while securing future healthcare funds.

Then you have the Flexible Spending Account (FSA). It also lets you set aside pre-tax cash for healthcare, but it comes with a big warning label. That money typically has a “use-it-or-lose-it” rule, meaning you need to spend it down within the year or risk forfeiting what’s left.

There is also the 401(k), the classic retirement plan. The immediate perk is that your contributions lower your taxable income right now. Your investments compound over time without annual tax drag, but the government will collect its share when you withdraw the money in retirement. Optimizing these withdrawals is a key component of effective retirement planning for high-net-worth clients who want to preserve their wealth.

When you weigh 401k vs HSA, the HSA stands out because it can cover today’s medical bills and act as a supplemental retirement fund later. That’s why many ask: Is HSA better than 401k? The answer depends on your healthcare spending, retirement horizon, and whether your employer provides matching contributions.

HSA vs FSA vs 401(k): Key Differences to Consider

1. Tax Treatment and Withdrawal Rules

An HSA is the only account that gives you a complete tax break on money going in, growing inside the account, and coming out for medical costs. With a 401(k), you get a tax break now but pay income tax on all withdrawals in retirement. An FSA uses pre-tax dollars but operates on a strict annual clock; spend it or potentially lose it. Navigating these distinct rules is why professional tax advisory and preparation is essential for avoiding costly mistakes.

2. Contribution Limits and Employer Matching

The government sets different saving caps for each account. For 2026, you can put up to $24,500 in your 401(k), but an HSA is much lower, around $4,300 for individual coverage. FSAs have a cap of about $3,300, but you must plan carefully to spend it all.

3. Flexibility and Eligibility Requirements

Not everyone can use an HSA. You need a specific high-deductible health plan to qualify. But if you have one, it’s the most flexible account; it’s yours for life, no matter where you work. A 401(k) is available to most employees, and an FSA is easy to get but is strictly “use it or lose it” each year and doesn’t move with you if you change jobs.

Which to Fund First? Order and Strategy

Your first move is always to contribute enough to your 401(k) to capture the full employer match. That’s an immediate 100% return. After securing that free money, shift your focus to maxing out your HSA. The superior tax efficiency of an HSA makes it the next priority. This approach answers a common dilemma: should I max out my HSA before my 401k beyond the match? For most, the answer is yes. This strategy optimizes both immediate gains and long-term tax savings across your HSA and 401k. This is one of the top questions to ask your tax preparer to ensure your contributions are working as hard as possible for you.

Practical Scenarios and Considerations

You Expect High Medical Costs or Retirement Healthcare Needs

Facing a year of braces or planning for future medical bills? This is where your HSA becomes a higher priority than the usual HSA vs 401k decision. By funding the HSA, you’re building a financial reserve for healthcare with tax-free dollars going in, growing, and coming out. It’s your most powerful tool for managing these specific costs.

You Have a Generous 401(k) Match and No HDHP Eligibility

When you cannot open an HSA due to plan restrictions, focus on your 401(k) and other available savings options instead. A strong employer match on your 401(k) is effectively guaranteed money for retirement. Contribute enough to capture the full match, then consider other tax-advantaged or taxable accounts to supplement savings if HSA funding is unavailable.

You Want a Balanced Strategy: Use Both Over Time

Most people find that a middle road works best. Start by putting enough in your 401(k) to get the full company match; that’s free money. Then, shift focus to fully funding your HSA. This one-two punch builds your retirement fund while creating a separate, tax-advantaged pool for medical expenses, both now and in the future.

Action Plan and Next Steps

Step 1: Evaluate Your Benefit Plan and Health Plan Eligibility

Start by digging into your health insurance details. Is it officially a High-Deductible Health Plan? That’s your ticket to HSA access. Next, find the fine print on your company’s 401(k) match. Knowing these two rules is critical before you can even think about whether to max out HSA or 401k. You need this information to build a smart plan. Understanding these details early is the best way to make your tax season trouble-free and avoid missed opportunities.

Step 2: Set Contribution Targets Based on Your Strategy

Once you know the rules, it’s time to fund your accounts in the right order. Your first move is always to grab the full 401(k) employer match. After that, pivot to funding your HSA. This sequence solves the HSA or 401k first dilemma, securing your match before building that powerful, tax-sheltered medical fund.

Step 3: Review Annually and Adjust Strategy

Mark your calendar for a yearly financial check-up, ideally during open enrollment. Did your health plan change? Did you get a raise? Life events can shift your strategy, forcing you to reconsider which account to max this year. A regular review keeps your savings on track and responsive to your current situation, not last year’s plan.

Conclusion

The 401k vs HSA debate has a clear winner for most people. Fund your 401(k) to get the full match, then pivot immediately to maxing out your HSA. This one-two punch leverages free money today while building the most tax-efficient account available for your future. That’s how you win the long game.

FAQ

- Q1: Is an HSA really better than a 401(k)?

A: Not always. HSA wins on tax efficiency and medical flexibility, but a 401(k) with a strong employer match can be more valuable. The ideal move is usually: get the full 401(k) match, then max your HSA.

- Q2: What if I can’t afford to fund both my HSA and 401(k)?

A: Prioritize the 401(k) match first so you don’t leave free money on the table. After that, put whatever extra you can into the HSA, even small amounts. Consistency matters more than size when you’re starting.

- Q3: Can I invest the money in my HSA like a 401(k)?

A: Often, yes. Many HSA providers let you invest once your cash balance hits a certain threshold. That’s what makes HSAs powerful: they can act like a “stealth IRA” for future medical costs if you invest and leave funds to grow.

- Q4: What happens to my HSA and 401(k) if I change jobs?

A: Your HSA is yours for life, regardless of your employer. Your 401(k) stays with your old plan until you roll it over to a new employer plan or IRA. An FSA usually doesn’t move with you and may be forfeited when you leave.

- Q5: When does an FSA make more sense than an HSA?

A: An FSA can be useful if you don’t qualify for an HSA but know you’ll have predictable medical costs, like regular therapy or prescriptions. Just be conservative with contributions to avoid losing unused money at year-end.

- Q6: Should I use my HSA now or save it for retirement?

A: If you can afford to pay current medical bills from cash flow, letting your HSA stay invested can supercharge its long-term value. But if cash is tight, using the HSA for today’s eligible expenses is still a solid, tax-smart move.

- Q7: How often should I revisit my HSA vs 401(k) strategy?

A: Check in at least once a year, ideally during open enrollment or after major life changes. New health plans, a raise, or a different employer match can all shift whether you prioritize the HSA, 401(k), or other savings.