What is Cost Segregation? Definition and Key Benefits

Learn how cost segregation helps property owners accelerate depreciation, reduce taxes, and boost cash flow through strategic asset classification and reclassification.

Table of Contents

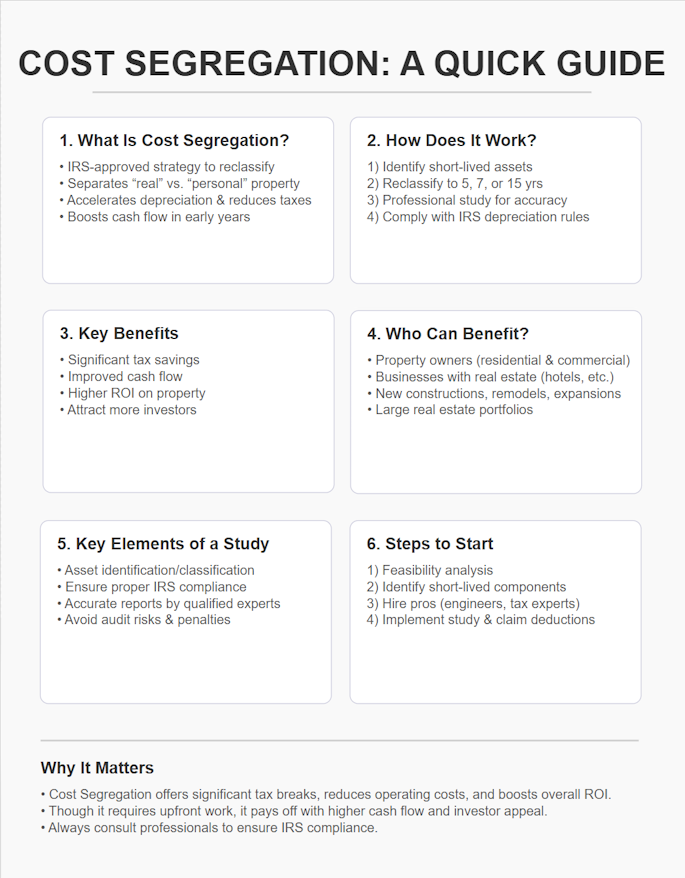

Cost segregation is an IRS-recognized tax planning strategy that allows real estate investors to maximize their depreciation deductions and defer federal and state income taxes after constructing, purchasing, remodeling or expanding any property.

Understanding the cost segregation definition and the associated tax savings can give you the financial relief needed to build or invest in commercial and residential properties often associated with high costs.

The Cost Segregation Process

A typical cost segregation process starts by identifying building components and assets that fall into tax categories but can be written off much quicker than the entire property structure, which would otherwise be depreciated over the standard 27 ½ or 39 years. These parts may include interior and exterior components that can be depreciated over 5,7 and 15 years.

While it can be tempting to undertake this process yourself, consulting with professionals is prudent, especially if you want to maximize tax savings on the strategy. Professionals like engineers and tax experts will review all pertinent documents, including architectural drawings, purchase agreements, and construction invoices for accurate quantification of the property’s components and the costs associated with each part.

Reclassifying Property Assets

In addition to defining what is a cost segregation process, you should be able to understand the difference between real property and personal property to identify immediate opportunities for accelerating depreciation deductions. Personal property, which is often depreciated over 5 to 7 years, may include tangible components like furniture, fixtures, carpeting, and specialized lighting.

On the other hand, real property may consist of land and other permanent structures around the property, such as landscaping, outdoor signage, and parking areas. These components are often depreciated over 15 years, depending on their longevity.

Benefits of Cost Segregation

Instead of treating your real estate property as a singular unit, cost segregation identifies and categorizes it into components to determine which assets qualify for shorter depreciation periods. This allows you to unlock a range of immediate and long-term benefits of cost segregation, including:

Tax Savings

Implementing a cost segregation strategy can help you claim deductions on components like roofing, HVAC systems, and pre-installed appliances during the earlier years of property ownership. This reduces your overall taxable income during those years and can be particularly advantageous if you initially fall in a higher tax bracket or plan to offset other income.

Improved Cash Flow

By claiming larger deductions in the early years of the property’s life, you can reduce overall tax liability and improve your overall cash flow. Streamlined cash flow translates to more capital and increased flexibility to explore other business opportunities, acquire additional real estate, or reinvest in the property.

Maximizing Real Estate ROI

Tax savings realized from implementing a cost segregation strategy can help you manage your property efficiently while optimizing operating costs over time. This will not only boost the real estate’s net income and valuation but also maintain its investor appeal in case you want to flip it in the future.

Have Questions About Cost Segregation?

Who Can Benefit from Cost Segregation?

Any taxpayer who owns real estate property as an individual or an entity can benefit immensely from an effective tax-saving strategy implemented by professionals rather than lifted straight from online cost segregation for dummies guide. These include:

Property Owners

After purchasing real estate, residential and commercial property owners can implement a cost segregation strategy to reclassify assets and adjust depreciation schedules to their advantage. The approach is also ideal for new construction projects if you want to maximize depreciation advantages immediately or an expansive real estate portfolio for enhanced cash flows and return on investments in the long term.

Businesses

Companies that own real estate can leverage a cost segregation study to identify which assets and areas of operations present opportunities for accelerating depreciation. For instance, businesses in the hospitality industry, such as hotels and resorts, can claim deductions on personal property investments, such as physical enmities and furnishings, especially if they qualify for shorter depreciation periods. Businesses across healthcare, manufacturing, and retail industries can also benefit from a similar approach.

Key Elements of a Cost Segregation Study

A cost segregation study comprises two key elements:

Identifying and Classifying Assets

A cost segregation study breaks down your residential or commercial property into “parts” after classifying the underlying assets. Examples of components that may be classified as “short-lived” assets, allowing them to accelerate depreciation deductions, include plumbing, electrical wiring, HVAC systems, and others.

IRS Compliance

The IRS provides stringent asset classification and depreciation guidelines to curb unscrupulous strategies that may lead to tax evasion. This implores businesses and property owners to engage qualified professionals with proven experience in implementing proper documentation to avoid unnecessary audits and penalties. Moreover, proper documentation facilitates accurate results that are compliant with IRS regulations.

Steps to Start a Cost Segregation Study

Understanding the cost segregation meaning in order to benefit from the underlying strategy can be daunting for new property owners. Fortunately, you can do it in two steps:

Feasibility Analysis

The first step is determining whether you need tax-saving strategies and whether your real estate property is ideal for cost segregation. You can do this by examining various components of the structure, such as electrical and plumbing systems. Unlike the entire property, these components can be depreciated over 5-15 years rather than the standard 27.5 years for residential buildings or 39 years for commercial properties.

Hiring Professionals

After conducting the feasibility analysis, you’ll need to hire professionals to gather additional information like closing documents, recent appraisals, and inspection reports to determine the accurate valuation of the property and its parts. The specialists will also prepare the final report indicating how much you can save on income taxes by claiming deductions on some of the identified components.

Conclusion: Why Cost Segregation Matters

Although cost segregation has an upfront cost and requires significant time and effort, the tax savings realized from accelerating depreciation deductions can result in various immediate and long-term benefits. This includes increased cash flow over several years, reduced operating costs in the long haul, and immediate retrospective benefits, such as huge tax deductions in the current year, especially if you want to catch up on missed depreciation opportunities without amending submitted tax returns.