Tax Planning for Trusts: A Guide to Minimizing Tax Liability

Discover strategies for tax-efficient trust planning, from choosing the right structure to avoiding costly mistakes, so you can protect assets, reduce taxes, and maximize benefits for your heirs.

Table of Contents

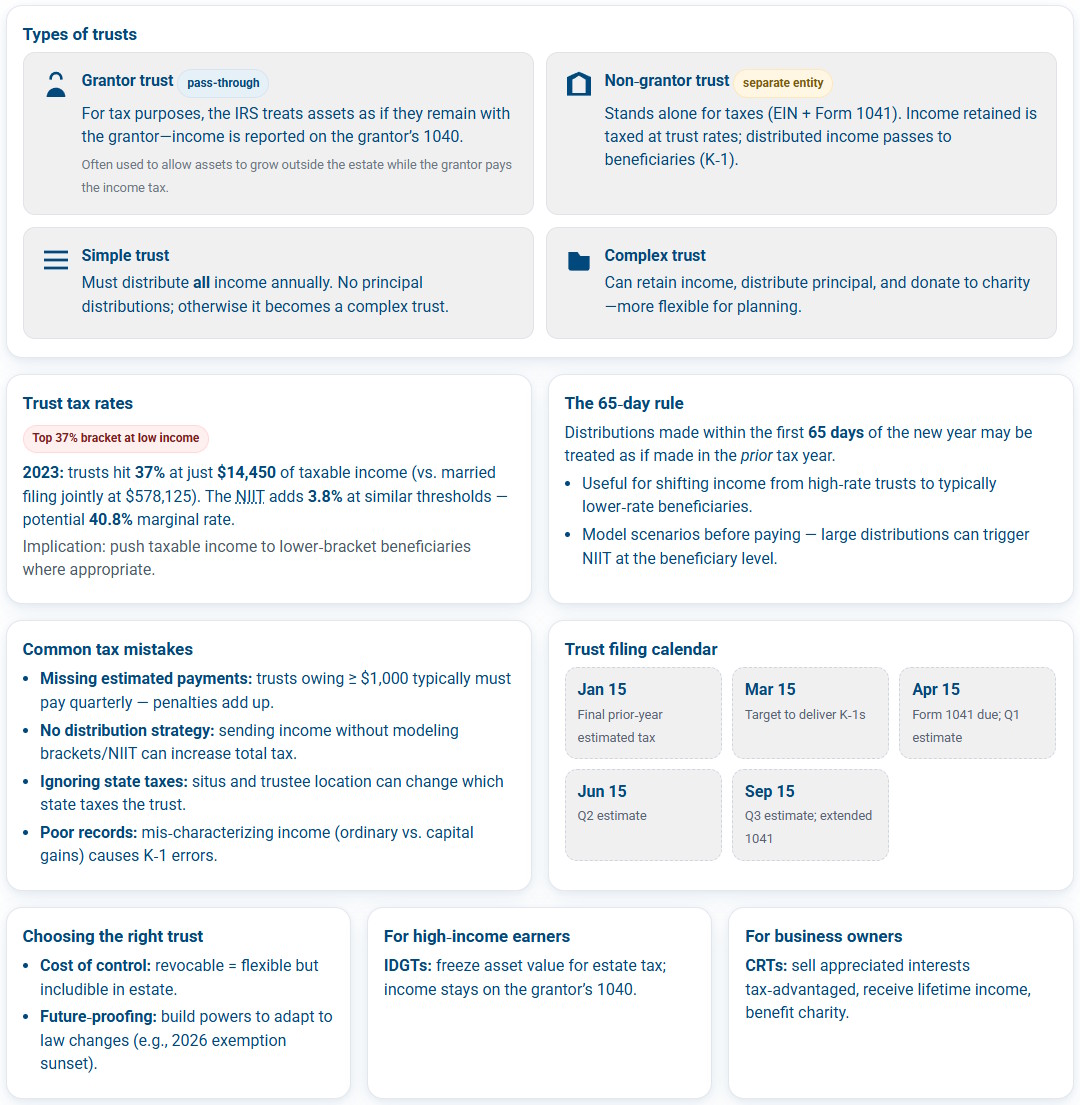

If you’ve ever tried to pin down how tax planning for trusts works, you know it’s not exactly straightforward. The IRS treats them like a chameleon, sometimes as a standalone taxpayer, other times as a pass-through vehicle (Abusive trust tax evasion schemes – Questions and answers). If the trust retains income, it files its own return and coughs up the owed amount. However, if a beneficiary gets the bill, distributions flow to them, meaning they’ll be required to report that income on their personal returns.

For a deeper dive into the filing rules, grantor vs. non‑grantor distinctions, and reporting obligations, see “Understanding Trust Taxation” on our blog.

Grantor Trust

Grantor trusts are like financial smoke and mirrors, but completely legal. When we set up this type of trust, the IRS pretends the assets never left the grantor’s hands (Investopedia – Grantor Trust Rules). That’s right; for tax purposes, it’s business as usual even though the assets are technically in the trust.

Wealthy families often prefer grantor trusts thanks to their tax efficiency. While the grantor keeps paying income taxes, which actually benefits heirs, the assets themselves can grow untouched by estate taxes.

Non-Grantor Trust

Unlike their grantor trust counterparts, non-grantor trusts stand on their own two feet with the IRS when it comes to trust tax planning. We’re talking about a completely separate tax entity here, the kind that needs its own Social Security number and files its own Form 1041.

The minute a trust fails to qualify as a grantor trust, it automatically gets slapped with non-grantor status.

Simple Trust

Don’t let the name fool you; there’s nothing “simple” about how these trusts operate. A simple trust is legally required to distribute all of its income every year, no exceptions. That means no squirreling away earnings for later, and no dipping into the principal for distributions. The moment it does, it graduates to “complex trust” status.

Complex Trust

Think of complex trusts as the Swiss Army knives of estate planning. They can do just about anything a simple trust can’t. Unlike their “simple” counterparts, which must distribute all income annually, complex trusts play by different rules. They can:

- Hold onto income instead of paying it out

- Distribute principal (corpus) when needed

- Make charitable donations directly from the trust

Trust Tax Rates

In 2023, a trust crosses into the 37% bracket at a mere $14,450 of taxable income, a threshold so low it would make most taxpayers laugh if it weren’t so painful. For perspective, married couples don’t hit that top rate until they clear $578,125. Trust Tax Rates and Exemptions for 2023 and 2024 (2025).

And here’s the kicker most families miss: that 3.8% Net Investment Income Tax (NIIT – Net Investment Income Tax) sneaks in at these same low thresholds. We’re talking about a potential 40.8% marginal rate before some trusts even have enough income to buy a decent used car.

The 65-Day Rule for Trusts

This IRS provision gives trustees a crucial window after year-end to strategically shift tax burdens from high-rate trusts to typically lower-rate beneficiaries.

The rule matters because while trusts hit the top 37% federal rate at just $14,450 (2023), most beneficiaries sit in lower brackets. That same $50,000 distribution could mean a 20%+ tax rate difference – real money that stays in the family instead of going to the IRS.

Use our Trust Tax Preparation Checklist to help trustees not overlook subtleties like the 65‑Day Rule during year‑end planning.

Common Tax Mistakes Trustees Should Avoid

Being named a trustee is an honor—until the first trust income tax bill arrives. Many well-intentioned trustees face penalties, frustrated beneficiaries, and even legal problems simply because they didn’t understand the tax pitfalls hidden in trust administration.

Below are the most frequent (and costly) mistakes, plus how to avoid them.

1. Missing Estimated Tax Payments

The IRS doesn’t make exceptions for inexperience. If a trust expects to owe $1,000 or more in taxes, it must make quarterly estimated payments: April 15, June 15, September 15, and January 15.

Failing to pay on time triggers penalties that can compound quickly. Unlike individual taxpayers, trusts don’t get the same leniency. A missed payment can mean:

- Underpayment penalties

- Cash flow crunches when the final bill hits

- Dissatisfied beneficiaries as trust assets shrink

Prevention tip: Work with a CPA experienced in trust taxation to calculate each payment accurately.

2. Distributing Income Without a Tax Plan

Too often, trustees distribute income on autopilot or skip distributions entirely—both can backfire.

Since trusts hit the 37% federal rate at just $14,450 (2023), shifting income to beneficiaries in lower brackets can save significant money.

Watch out for: The 3.8% Net Investment Income Tax (NIIT), which applies if a beneficiary’s income exceeds certain thresholds. Poor timing could push them into higher taxes instead of saving money.

Prevention tip: Coordinate distributions with a tax professional before year-end to optimize for both the trust’s and beneficiaries’ tax brackets.

3. Ignoring the 65-Day Rule

This IRS provision allows trustees to treat certain early-year distributions as if they were made in the prior year – helping move income from a high-tax trust to lower-tax beneficiaries. Missing this window can mean paying more tax than necessary.

Prevention tip: Review projected trust income in January and decide quickly if a 65-day rule election (via Form 1041) would reduce the tax burden.

4. Overlooking State-Level Taxes

Many trustees focus on federal taxes and forget that some states impose steep income taxes on trusts – even if the trustee or beneficiaries live elsewhere.

Prevention tip: Check both the trust’s situs (legal location) and the states where beneficiaries reside to understand total tax exposure.

For help untangling multi‑state tax obligations (especially where beneficiaries span jurisdictions), see our guide on Navigating State Income Tax Apportionment.

How to Choose the Right Trust for Tax Efficiency

Selecting the optimal structure during tax planning for trusts is about matching legal vehicles to your unique financial DNA. The difference between a well-structured trust and a generic one could mean saving your heirs six figures in unnecessary taxes.

Questions to Ask When Setting Up a Trust

What’s the real cost of control?

Revocable trusts offer flexibility but keep assets in your taxable estate. I recently reviewed a case where this “convenience” cost a family $287,000 in avoidable estate taxes.

What’s the contingency plan for changing laws?

With the estate tax exemption scheduled to sunset in 2026, your trust needs to be built with flexibility. I always recommend including trustee powers to modify distributions based on future tax landscapes.

Aligning Trust Goals with Tax Planning Objectives

For High-Income Earners

Consider IDGTs (Intentionally Defective Grantor Trusts). These trusts freeze asset values for estate tax purposes while shifting all income tax liability to you (at presumably lower individual rates).

For Business Owners

A well-structured CRT (Charitable Remainder Trust) can liquidate appreciated business interests tax-free, providing lifetime income while benefiting charities.

Trust Tax Filing Requirements and Deadlines

Filing taxes for a trust isn’t like handling your personal 1040. The rules are stricter, the penalties are harsher, and the margin for error is razor-thin. As a trustee, your first duty is to understand these requirements inside and out.

Key IRS Forms: 1041 and K-1 Overview

Form 1041: The Trust’s Tax Return

Think of this as the trust’s version of a W-2. It reports:- All income (dividends, capital gains, rental income)

- Deductible expenses (trustee fees, legal costs, tax prep fees)

- Taxable income after distributions

Schedule K-1: The Beneficiary’s Tax Ticket

Each beneficiary receives this form showing:- Their share of distributed income

- Character of income (ordinary vs. capital gains)

- Any credits or deductions passed through

Important Deadlines for Trustees and Fiduciaries

The Non-Negotiable Calendar

April 15:

- Form 1041 due for calendar-year trusts

- First estimated tax payment due

June 15:

- Second estimated tax payment due

September 15:

- Third estimated tax payment due

- Extended 1041 deadline (if Form 7004 filed)

January 15:

- Final estimated tax payment for prior year

March 15:

- K-1 distribution deadline to beneficiaries

When to Review or Update a Trust Tax Strategy

A trust isn’t a “set it and forget it” document. It’s a living financial instrument that needs regular tune-ups. The tax code changes. Your assets change. Your beneficiaries change. And if your trust doesn’t evolve with them, you’re leaving money on the table or worse, inviting IRS scrutiny.

Triggering Events: Death, Asset Sale, or Law Changes

Three seismic shifts should prompt an immediate trust review: First, the death of a grantor or beneficiary, which alters control and distributions. Second, selling major trust assets, say a $500K capital gain, hits differently at trust rates. Third, tax law changes like the 2026 estate tax exemption sunset.

Annual Reviews with a CPA or Estate Attorney

Your trust tax planning review should examine: income shifting opportunities between trust and beneficiaries, changing state tax implications, and whether distributions still align with beneficiaries’ tax brackets. The best trustees we know schedule these meetings right after receiving their third-quarter investment statements.

Have Questions About Tax Planning for Trusts?

FAQ

- Q1: 1. What is the main difference between a grantor and non-grantor trust?

A: A grantor trust is taxed as if the assets still belong to the grantor, while a non-grantor trust is treated as a separate taxpayer and files its own return using Form 1041.

- Q2:How is income from a trust taxed to beneficiaries?

A: If the trust distributes income, beneficiaries report it on their personal tax returns using Schedule K-1, which lists their share and the character of income.

- Q3: Why are trust tax brackets considered harsh?

A: Because trusts hit the top 37% federal tax rate at just $14,450 of income (2023), plus a 3.8% NIIT, creating an effective rate of up to 40.8% on relatively low income levels.

- Q4: When should a trust tax strategy be reviewed?

A: At least annually, and immediately after major events like a grantor’s death, sale of significant assets, or changes in tax laws, such as the upcoming estate tax exemption sunset in 2026.

- Q5: Which forms do trustees need to file?

A: Trustees file Form 1041 for the trust and issue Schedule K-1 to beneficiaries. Deadlines generally follow the individual tax calendar, with key dates in April, June, September, and January.