ES CPA BUSINESS SERVICES

CFO Outsourcing Services

Outsource CFO services to Evans Sternau specialists to bolster your company’s financial strategy, solve challenges proactively and drive business growth with prudent decision-making without breaking the bank.

Why Outsource Your CFO?

Key Reasons Outsourced CFOs are Important

Outsourced CFO services are crucial for businesses seeking strategic financial guidance without the overhead of hiring a full-time executive. These services provide professional insights into financial planning, budgeting, and forecasting, helping businesses make informed decisions.

An outsourced CFO can identify financial trends, streamline operations, and develop tailored strategies to enhance overall financial performance. Engaging a CPA for these services amplifies their value, as CPAs bring a deep understanding of accounting principles, tax implications, and regulatory compliance. This expertise allows them to provide comprehensive financial analysis and strategic recommendations that are both actionable and aligned with the business’s goals.

- Cost Effective

- Enhanced Financial Analysis

- Scalability

- Proactive Insights

- Trust & Credibility

- Strategic Financial Planning

- Focus on Core Operations

Our Difference

What Makes Evans Sternau CPA Different?

Evans Sternau CPA has a stellar track record of delivering top-tier outsourced CFO services for startups, private equity-backed firms and businesses that have existed for years. Whether hired full-time, part-time or as an interim for a specified duration, we bring diverse qualities that make us stand out from the competition. These include:

Expertise Backed by CPA Knowledge

While chief financial officers don’t necessarily need to be accountants, our outsourced CFO service providers possess extensive CPA knowledge to address your unique business challenges. This includes a solid grasp of accounting principles, budgeting, analysis, risk management and compliance to ensure the company’s decisions are financially sound in terms of resources and legal obligations.

Personalized and Flexible Service Packages

Our outsourced CFO service packages are flexible and personalized, allowing you to focus on the financial needs most relevant to your business at any time instead of being restricted to a standard offering. You can choose from Essential, Premium, or Concierge packages to benefit from additional services on top of the standard on-call business & tax consultations.

Proven Success Across Diverse Industries

As an expert in providing outsourced accounting CFO services, Evans Sternau has built a solid reputation across diverse industries and helped clients achieve their overarching business goals with strategic collaboration. Whether your business operates in an established or emerging industry, you can count on our professionals to walk you through prudent planning, implementation, and management of every aspect of its financial activities.

Outsourced CFO Service Packages

Outsourced CFO

On Call Business & Tax Consultations

Scheduled Meetings

Standard Business Performance Dashboard

Customized Financial Performance Dashboard

Annual Budget & Performance Monitoring

Cash Flow & Profitability Forecasting

Essential

- On-Call Business & Tax Consultations

- Standard Business Performance Dashboard

Premium

- On-Call Business & Tax Consultations

- Standard Business Performance Dashboard

- Annual Budget & Performance Monitoring

- Cash Flow & Profitability Forecasting

Annual

Concierge

- On-Call Business & Tax Consultations

- Customized Business Performance Dashboard

- Annual Budget & Performance Monitoring

- Cash Flow & Profitability Forecasting

Quartlery

The CFO Solution

Why Hire an Outsourced CFO?

Outsourced CFO services, including cash flow projections and annual budgets, provide businesses with financial guidance and strategic planning without the need for a full-time, in-house CFO. This cost-effective solution allows companies to access the specialized knowledge and skills of experienced financial professionals on an as-needed basis.

Accounting Methods

Tax planning for accounting methods, such as cash or accrual, involves selecting the most advantageous approach to record income and expenses for tax reporting purposes. The cash method records transactions when cash is received or paid, offering simplicity and immediate tax recognition. The accrual method records transactions when they occur, aligning with business operations but potentially deferring tax recognition. Businesses can strategically choose between methods, optimizing tax liability based on timing, industry, and income patterns. Careful consideration of each method’s implications helps tailor an approach that maximizes tax benefits and financial reporting accuracy.

Analysis & Coordination of

QBI & Reasonable Wage

A reasonable wage for an S corporation refers to the fair and justifiable compensation that an owner-employee receives for their work in the business. It should reflect what the individual would be paid for the same work in a similar position at another company. Determining a reasonable wage is essential because S corporation owners often take a portion of their income as distributions rather than wages to reduce payroll taxes, and the IRS requires that a reasonable salary be paid to avoid tax evasion.

Company Paid Benefits

C corporations can provide tax benefits to their employees through company-paid benefits, as these benefits are typically considered tax-deductible business expenses for the corporation. Common benefits, such as health insurance, retirement plans, and educational assistance, can reduce the taxable income of the business, which, in turn, can lower the company’s overall tax liability. Additionally, these benefits can be offered to employees on a tax-advantaged basis, as they are often not counted as taxable income for the employees, enhancing the overall compensation package and potentially reducing their personal tax liability.

Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a U.S. tax incentive introduced in response to the COVID-19 pandemic. It offers eligible employers a credit against payroll taxes for retaining employees during periods of economic hardship. Businesses that experienced significant revenue decline or were subject to government orders could claim a credit for a portion of wages paid to employees. The ERC aimed to encourage employers to maintain their workforce and provide financial relief during challenging times. Eligibility and credit amounts vary based on specific criteria, making it a valuable tool for businesses navigating economic disruptions.

Historical E&P Study

A Historical Earnings and Profits (E&P) Study is an analysis conducted by corporations to determine the distribution of dividends to shareholders without incurring additional taxes. It involves examining the company’s past financial records to calculate its historical E&P, which reflects the cumulative net income, deductions, and distributions over time. This study ensures that dividends are classified accurately, helping corporations allocate distributions as either dividends, return of capital, or capital gains. By understanding their historical E&P, businesses can make informed decisions about dividend distributions that align with tax regulations and optimize shareholder returns.

R&D Credit

The Research and Development (R&D) tax credit is a U.S. incentive designed to encourage innovation and technological advancement. It offers businesses, both large and small, a tax credit for qualified research expenses, including wages, supplies, and certain overhead costs related to developing or improving products, processes, or software. The credit aims to stimulate investment in research and innovation across various industries. By reducing the tax liability, the R&D credit supports companies in pursuing research endeavors, fostering growth, and enhancing competitiveness. Proper documentation and adherence to IRS guidelines are crucial to effectively claim this credit.

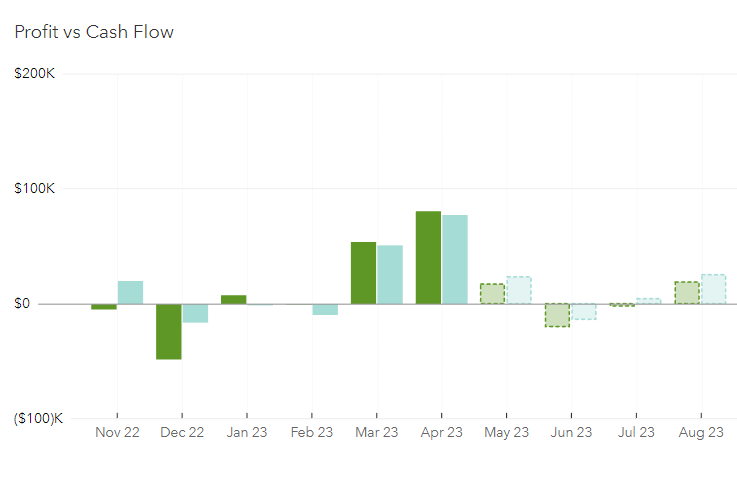

Cash Flow Forecast

A cash flow forecast is a financial projection that outlines the expected inflows and outflows of cash for a specific period, typically monthly or quarterly. It provides insights into a business’s liquidity by estimating when and how much cash will be received from sales, investments, and financing, as well as when and how much cash will be spent on expenses and investments. Cash flow forecasts help organizations anticipate potential cash shortages or surpluses, aiding in strategic decision-making, budgeting, and ensuring sufficient funds for operations, debt payments, and growth initiatives.

Accountable Plan

Disbursement

Being reimbursed under an accountable plan provides great tax savings. It is an excellent way to get money out of your s corporation tax free. The corporation can deduct the amount of the reimbursement and you do not have to report the payment on your personal income taxes.

Cost Segregation Study

A cost segregation study is a detailed analysis conducted on commercial real estate properties to identify and reclassify components of the property for accelerated depreciation. By segregating different assets within the property, such as fixtures, building components, and personal property, and assigning them shorter depreciation lives, investors can front-load depreciation deductions, reducing taxable income and increasing cash flow. This strategy benefits property owners by lowering their tax liability in the earlier years of ownership. Cost segregation studies require engineering and tax expertise to ensure compliance with IRS regulations and accurate allocation of assets.

Financing

Establishing financing for a new business is essential as it provides the necessary capital to cover startup costs, operational expenses, and investments in growth. Adequate financing allows a business to navigate initial challenges, seize opportunities, and weather financial downturns, contributing to its long-term sustainability. It also instills confidence in potential investors, lenders, and stakeholders, demonstrating that the business is well-prepared and has the resources needed to execute its business plan effectively.

Insurance & Medical Expenses

Establishing insurance and medical coverage for a new business is vital as it helps mitigate financial risks associated with unexpected events, such as accidents, liability claims, or property damage. Having insurance can protect the business and its assets, providing peace of mind to the owner and stakeholders. Additionally, offering medical coverage to employees can attract and retain top talent, leading to a healthier and more productive workforce, which is crucial for the business’s success and long-term growth.

Work Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a U.S. federal tax incentive designed to promote employment of individuals facing barriers to workforce entry. Employers who hire individuals from specific target groups, such as veterans, ex-felons, and long-term unemployed individuals, can claim a tax credit. The credit’s value is based on the employee’s wages and hours worked. The WOTC encourages inclusive hiring practices by providing financial incentives to businesses that support workforce diversity and contribute to reducing unemployment rates among disadvantaged populations. Adherence to specific eligibility criteria and documentation requirements is essential to claim this credit.

CFO Service Highlights

Key Features of Our Outsourced CFO Services

By outsourcing CFO services to Evans Sternau, you position your business to work with specialists who will create a personalized plan of action that navigates around business risks and seizes financial opportunities as they arise. Here are the key features of our professional services outsourced CFO:

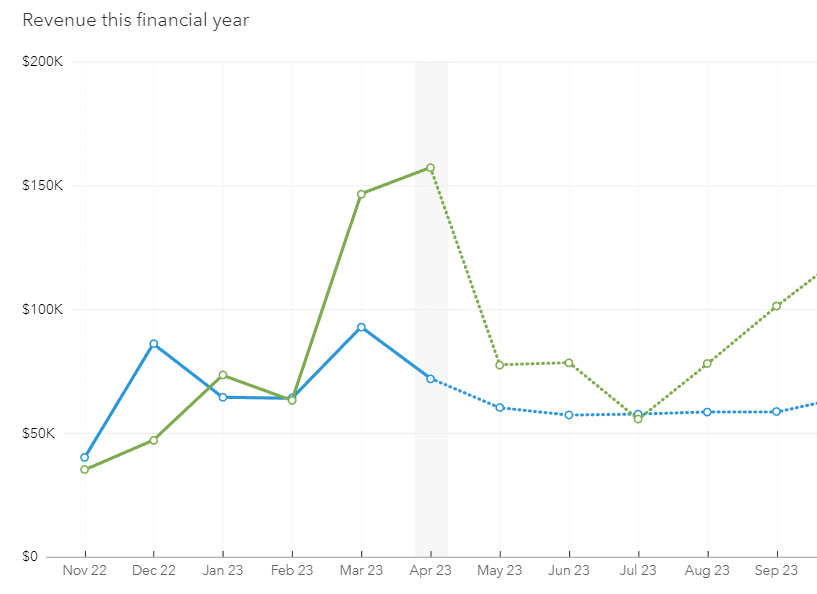

Real-Time Financial Insights

Our outsourced CFO business advisory services allow your company to track its financials and gain real-time actionable insights. This can be done through Evans Sternau CPA’s standardized dashboard, which tracks prevalent performance metrics like cash flow and profitability. Alternatively, our team can help you build a customized dashboard that integrates all your financial and operational data into a report personalized for your business.

Scalable Solutions for Growing Businesses

We provide scalable outsourced CFO services, allowing your business to rapidly innovate and adapt to financial changes in the market. Additionally, our scalable solutions equip you with the flexibility and agility needed to outfox the competition in today’s fast-moving business landscape, where saving costs, optimizing performance, and streamlining customer service without impacting normal operations are the keys to success.

Tailored Financial Strategies for Your Goals

Evan Sternau CPA’s outsourced CFO service encompasses a personalized approach that addresses your business’s unique financial needs and goals. You can count on our experts to design all-around financial planning programs, formulate risk management protocols, and implement strategies to improve profitability. Moreover, our CFO can collaborate with your in-house experts as much as needed to foster positive synergies for navigating critical periods.

How We Assist

How We Can Help

Cash Flow & Profitability Forecasting

Cash flow projections play a vital role in financial planning by forecasting the inflows and outflows of cash over a specific period. These projections help businesses anticipate:

✓ Future cash positions

✓ Identify potential gaps

✓ Make informed decisions to ensure sufficient liquidity

An outsourced CFO can leverage their expertise to develop accurate and detailed cash flow projections tailored to the unique needs of the business.

Annual Budget Creation & Performance Monitoring

Annual budgets are crucial for effective financial management and goal setting. An outsourced CFO collaborates with the company’s management team to create comprehensive budgets that align with the organization’s strategic objectives. These budgets provide a roadmap for:

✓ Allocating resources

✓ Tracking performance

✓ Making informed financial decisions throughout the year

Business Performance Dashboards

Monitor your business’ financial performance in one of two ways:

✓ Utilize Evans Sternau CPA’s standardized dashboard, which includes many of the commonly used performance metrics such as profitability, cash flow, accounts receivable monitoring.

✓ Let us build your customized dashboard, integrating all of your financial and operational data into a report tailored to your business. In addition to our standard metrics, the custom dashboard can provide key insights into customer, business unit and employee performance.

Benefits of Partnering with Us

At Evena Sternau CPA, we pride our outsourced accounting CFO services on various qualities that help us take your startup’s financial management to a new level while remaining compliant with local and federal legal provisions. For starters, working with us exposes your venture to a ton of business benefits, including:

Cost Savings Without Compromising Quality

While we offer a relatively affordable outsourced CFO services cost to match your budget, our work is exceptional and encompasses hands-on technical assistance to improve bottom-line results without compromising quality. Moreover, this approach allows you to access a qualified CFO’s high-level financial insights and leadership without the expensive cost and commitment of hiring one full-time.

Access to Industry-Leading Financial Tools

In addition to offering an unbiased perspective and unparalleled industry experience, our outsourced CFO service providers will help your business access the latest financial tools and technologies for a competitive edge. These include advanced financial software for tracking and analyzing the startup’s financial health in real-time, leading to improved profitability and better client service delivery.

Expert Guidance for Long-Term Growth

We connect businesses with top-rated outsourced CFOs who can identify cost-saving opportunities from the onset and provide expert guidance for long-term growth. This includes calling out inefficient processes that have been overlooked due to the continued lack of expertise and fine-tuning the business’s forecasting capabilities to improve the speed and depth of future decision-making.

Results You Can Expect

Clients from mainstream and nascent industries count on our trusted outsourced CFO service to better understand the financial health of their businesses and scale quickly to meet dynamic market and customer needs. By partnering with us, you can expect achievable short-term and long-term results, including:

Improved Cash Flow and Profitability

Evans Sternau’s outsourced CFO services for startups have proven to increase long-term business value by allocating more resources to business units and customer segments that generate recurrent revenue. In the long haul, this enhanced cash flow and profitability allows your business to reinvest in critical areas like marketing and human resources for stimulated revenues.

Streamlined Financial Reporting

With in-depth expertise in financial knowledge, our CFOs can analyze vast documents and enhance your startup’s financial reporting by integrating qualitative characteristics, such as comparability, verifiability, timeliness and understandability. CFOs can also leverage advanced financial reporting software to automate repetitive tasks, enhance accuracy and mitigate potential human errors.

Better Decision-Making with Data-Driven Insights

Outsourcing CFO services to Evans Sternau CPA experts allows your business to tap data-driven insights drilled down from high-level metrics into granular details that can help improve decision-making in the long run. This approach allows you to understand trends, identify new business opportunities and respond to market changes more swiftly while resolving issues proactively.

Blog

Latest Insights

Stay Informed: Explore Our Blog for In-Depth Analysis on Outsourced CFO Solutions:

FAQ

- Q1: What does an outsourced CFO actually handle?

A: They build budgets, forecast cash flow and profitability, create performance dashboards, and guide strategy without the cost of a full-time hire.

- Q2: How do your service packages differ?

A: Essential includes on-call consultations and a standard dashboard; Premium adds budgets and forecasting; Concierge layers in a customised dashboard and more frequent monitoring.

- Q3: Can you work part-time or as an interim CFO?

A: Yes. Engagements can be full-time, part-time, or interim for a defined period based on scope and goals.

- Q4: What will I see in the performance dashboard?

A: Key metrics like profitability, cash flow, and AR - plus options to integrate customer, unit, and employee insights in a custom build.

- Q5: How does a CPA background help?

A: CPA oversight adds rigor across accounting, tax, and compliance so your financial plan aligns with regulations and supports sound decisions.

- Q6: Do you support tax credits and incentives?

A: Yes. Advisory can include R&D credits, ERC, Work Opportunity Tax Credit, and other incentives if you’re eligible.

- Q7: What business results should we expect?

A: Better cash visibility, stronger reporting, and faster, data-driven decisions that support long-term growth. (Tie to dashboards, budgets, and forecasting deliverables.)

- Q8: How do we get started?

A: Complete the short questionnaire or schedule a call to scope your goals and package fit.

In Need of Outsourced CFO Services?

The fastest way to get started with Evans Sternau CPA is filling out our questionnaire. Have questions? Not a problem – feel free to give us a call.