ES CPA BUSINESS SERVICES

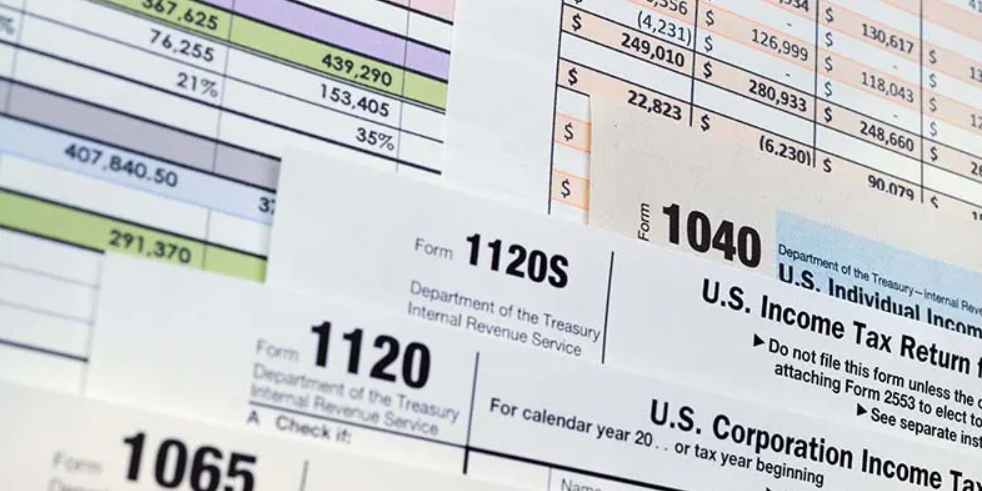

Business Entity Selection Services

Evans Sternau CPA provides entity selection services to help businesses choose the right legal structure for their needs. Our experienced team assesses your goals, liability concerns, and tax implications to recommend the most advantageous entity type. Navigate the complexities of business formation with confidence and ensure a solid foundation for your success.

What is Entity Selection?

Entity selection refers to the process of choosing the appropriate legal structure for a business. This decision is critical as it affects liability, taxation, management structure, and regulatory requirements. Common entity types include sole proprietorships, partnerships, limited liability companies (LLCs), S corporations, and C corporations.

How Entity Selection Affects a Business

Entity selection is a crucial way to minimize tax burdens. Here is a list of how it may effect your business:

- Tax Obligations: The chosen entity type directly impacts how a business is taxed, influencing cash flow and profitability.

- Operational Complexity: Different entities have varying levels of complexity in terms of regulatory compliance, reporting, and governance, which can affect operational efficiency.

- Personal Liability: The level of personal liability protection varies by entity type, impacting the risk exposure of the owners.

- Funding and Growth Potential: The structure can affect the ability to raise capital and expand the business, as some entities are more attractive to investors than others.

How a CPA Helps with Entity Selection

- Assessment of Business Needs: They can assess the specific needs of the business, including liability concerns, growth plans, and operational complexities, to recommend the best entity type.

- Compliance Guidance: CPAs help ensure that the chosen entity complies with all legal and regulatory requirements, reducing the risk of penalties or legal issues.

- Long-Term Planning: They provide insights into how the entity structure may impact long-term financial and business goals, helping owners make informed decisions.

- Ongoing Support: CPAs offer ongoing tax planning and advisory services as the business grows, ensuring that the entity structure continues to align with the company’s needs.

- Documentation and Setup: They can assist in preparing the necessary documentation for entity formation and registration, ensuring that everything is in order from the start.

BENEFITS OF

Entity Selection Service

Credibility

Choosing a formal business structure can enhance credibility with customers, suppliers, and investors.

Flexibility in Management

Some entities, like LLCs, offer more flexibility in management structure compared to corporations, which have more formal requirements.

Investment Opportunities

Corporations, particularly C corporations, can issue stock to attract investors, providing more opportunities for raising capital.

Liability Protection

Different entities provide varying levels of personal liability protection, which can shield personal assets from business debts and legal actions.

Tax Advantages

Certain entities offer favorable tax treatments. For example, LLCs and S corporations can allow for pass-through taxation, while C corporations can benefit from lower corporate tax rates on retained earnings.

More About Evans Sternau CPA

Our core values are proactiveness, responsiveness, and support – they help us ensure that we continue to serve each and every one of our clients to the highest level possible

- Proactiveness: Tax, accounting, and advisory isn’t just about solving problems when they arise – Evans Sternau CPA implements better solutions and performs routine checks year-round.

- Responsiveness: Keeping all parties informed, always, means everyone is operating with full awareness and to the fullest extent.

- Support: Whatever your tax, advisory, and accounting needs are, Evans Sternau CPA guarantees that we make each and every one of our clients feel supported when they work with us.

Why Trust Evans Sternau CPA

The last thing you should be worried about, particularly during tax season, is chasing down your CPA firm for information – with Evans Sternau CPA, you won’t have to.

Our team of experienced accountants is committed to using our multifaceted experience to bring you proactive accounting solutions. In a time crunch and need something from us? Reach out – we’ll get back to you quickly, with all of the information you require.

Ready to work with a Proactive CPA?

While we are a CPA firm in The Woodlands, we service clients across the United States. Click below to get a quote or give us a call with any other questions you may have.