BUSINESS SERVICES

Business Compliance Services & Accounting Solutions

We handle our client’s accounting and compliance obligations to let them focus on running a successful business. Evans Sternau CPA can help your business bolster its financial integrity, reduce reputation risk, improve accountability and deliver a competitive edge.

Accounting's Importance

Key Reasons Accounting & Compliance is Important

Accurate accounting provides a clear picture of a company’s financial health, enabling informed decision-making and strategic planning.

Compliance services help mitigate the risk of legal issues and penalties by ensuring that the business meets all regulatory requirements.

Engaging a CPA for these services brings additional benefits, as CPAs possess specialized knowledge and experience in accounting principles and compliance regulations. This partnership not only enhances operational efficiency but also fosters trust with stakeholders, ultimately supporting sustainable growth and success.

- Accurate Financial Reporting

- Regulatory Compliance

- Operational Efficiency

- Proactive Guidance

- Risk Management

- Comprehensive Services

- Attention to Detail

Why Professional Tax Help Matters

Why Businesses Need Accounting & Compliance Services

Professional accounting and business compliance services can help companies save time, improve financial accuracy, and avoid regulatory risks. By working with professional accountants, your business can benefit from strategic decision-making and tailored tax-saving structures.

Risks of Non-Compliance and Penalties

Businesses are responsible for ensuring that their activities are conducted in accordance with laws and regulations. Non-compliance can lead to penalties such as fines, license revocation or imprisonment.

Businesses impacted by penalties can also suffer irreversible reputational damage and indefinite interruptions, leading to loss of revenue and customer trust.

Benefits of Outsourced Accounting for Growing Businesses

Outsourcing your accounting and compliance needs to a reputable firm like Evans Sternau CPA can optimize your business operations and maximize profits. Trust us to provide proactive assistance, giving you time to breathe and shift focus on what matters to your startup.

Cost Savings and Efficiency

By working with third-party accounting services for businesses, you can avoid the costs of hiring and training a fully-fledged in-house team, buying and maintaining accounting software, and paying employee benefits. Outsourcing allows you to pay only for what you need, freeing up extra capital to fund other business operations.

Access to Professional Financial Insights

Outsourcing your accounting roles gives you access to highly skilled and experienced professionals who can provide top-tier accounting financial solutions tailored to your business. These experts will give you strategic guidance and data-driven financial insights geared towards prudent decision-making and ultimate business success.

Your Compliance Partner

Our Full-Scale Accounting & Compliance Services

Evans Sternau CPA is a trusted provider of full-scale accounting and business compliance services across numerous industries. Partner with us for:

Compliance Services for Stress-Free Operations

Sales Tax Preparation

and Filing

Stay abreast of your sales tax returns with the help of CPA compliance experts, who can ensure accurate calculations and timely filings to avoid penalties. Additionally, we keep up with changing regulations and rates to advise you better on how to minimize sales tax liabilities while remaining compliant to avoid unnecessary audits.

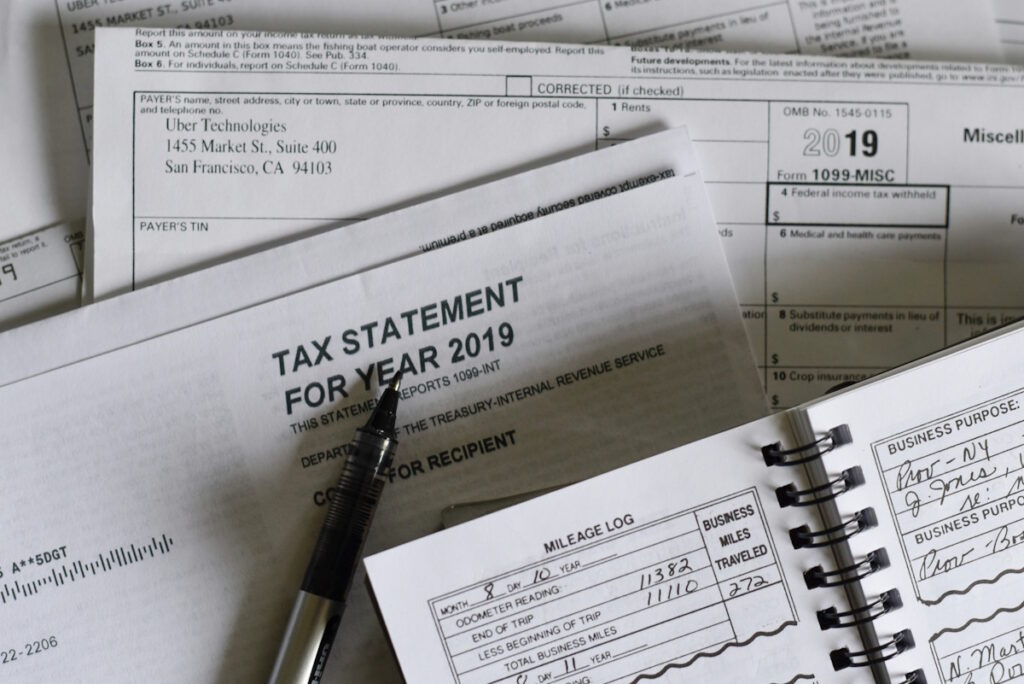

1099 Reporting

and Management

Tap our 1099 reporting and management services to simplify independent contractor payments and optimize compliance with IRS regulations. Our goal is to ensure your business reports accurate earnings and withholds correct taxes based on contractor classification as you focus on improving core operational areas.

Regulatory Compliance for Financial Statements

Trust our specialists to work with you year-round to ensure you prepare accurate financial statements that are compliant with county, state and federal laws. Count on us to help you minimize the risks of penalties, random audits or reputational damage that may arise from non-compliance.

Accounting Support Tailored to Your Needs

Transaction Recording and Bank Reconciliation

Our specialists leverage advanced accounting software to automate repetitive tasks like transaction recording and significantly reduce the time and effort required for reconciling with banks. This allows you to identify, track quickly and resolve inconsistencies, ensuring that your financial statements are always accurate and up-to-date.

Accounts Payable and Receivable Management

Trust Evans Sternau CPA professionals to provide a cost-saving strategy for quickly turning your company’s outstanding accounts receivable into cash. We can ensure efficient accounts payable management to help you maintain healthy business relationships with suppliers, vendors, financiers, and others you owe.

Accounting Options

Our Accounting & Compliance Services

Regardless of the size of your business, we have an accounting service that fits your needs. Our Essential plan is for the “do it yourself” business owner that needs someone to help with complex accounting transactions and an occasional check-in to make sure everything is correct. Our Premium plan is a traditional, after-the-fact, bookkeeping service. For companies that need more support, we offer a comprehensive Outsourced Controller service to handle all of your day-to-day accounting.

Accounting

Compliance

Not Just Income Tax

Accounting & Compliance Service Packages

Accounting & Compliance

On-call accounting support

Quarterly accounting review

Transaction coding and bank reconciliations

Sales tax

1099s

Inventory Management

Cost and revenue allocations by business unit

Invoicing and Accounts Receivable management

Billing and Accounts Payable management

Essential

- On-call accounting support

- Quarterly financial statement maintenance

Premium

- On-call accounting support

- Transaction coding and bank reconciliations

- Sales tax

- 1099s

Concierge

- On-call accounting support

- Transaction coding and bank reconciliations

- Sales tax

- 1099s

- Inventory management

- Cost and revenue allocations by business unit

- Invoicing and Accounts Receivable management

- Billing and Accounts Payable management

How We Assist

How We Can Help

Bookkeeping

Bookkeeping services provide businesses with accurate financial records, saving time and enabling owners to focus on core operations. They offer valuable insights into financial health, streamline tax preparation, and help manage cash flow, ensuring compliance with regulations.

When combined with the expertise of a CPA, businesses gain a strategic advantage. CPAs provide financial advice, assist with tax efficiency, and offer support during audits. To maximize this partnership, maintain clear communication, schedule regular check-ins, and ensure organized records. Utilizing technology can also enhance collaboration, allowing for efficient data sharing and alignment on financial goals. Together, bookkeeping services and a CPA create a solid foundation for informed decision-making and sustainable growth.

Sales Tax

Sales tax services help businesses navigate the complexities of tax compliance, ensuring accurate calculations and timely filings to avoid penalties. They keep up with changing regulations and rates, reducing the risk of errors that can lead to audits.

Partnering with a CPA enhances this process, as CPAs bring expertise in tax strategy and can provide insights into minimizing sales tax liabilities. To work effectively with a CPA, businesses should maintain organized records and communicate regularly about their sales activities and any changes in operations. By leveraging technology for data sharing and staying proactive about compliance, companies can streamline sales tax management and focus on growth while ensuring adherence to regulations.

1099’s

1099 services simplify the management of independent contractor payments and compliance, ensuring that businesses accurately report earnings and withhold the correct taxes. These services help prevent costly mistakes that can lead to penalties and audits by ensuring timely filing and adherence to IRS regulations.

Working with a CPA enhances the effectiveness of 1099 services, as CPAs can provide strategic advice on contractor classifications and tax implications. To maximize this collaboration, businesses should maintain organized records of contractor payments and communicate any changes in staffing or project scopes. By staying proactive and leveraging technology for data sharing, companies can ensure smooth 1099 management while focusing on their core operations and compliance needs.

Our CPA Advantage

Why Choose Evans Sternau CPA

We provide top-notch CPA compliance and accounting services to take the guesswork out of your financial management, which is the cornerstone of a successful business. Clients choose to work with us because we provide:

Experienced and Trusted CPA Professionals

Our team members are not only qualified academically but also trusted by industry peers, regulatory bodies, and other businesses. With us handling your accounting and compliance needs like fellow business partners, you can rest assured you’re in safe hands and can focus on managing your business without worries.

Tailored Services for Every Industry

For years, our CPA firm has garnered a wealth of combined experience serving clients across multiple industries, including nascent and mainstream industries. Whether you’re running a business in the home office, manufacturing and distribution, retail, healthcare, or leisure and hospitality, you can count on us to deliver tailored services that address your intricate needs.

Transparent and Scalable Pricing

Small and established businesses trust our experts to provide stellar accounting services that match their budgets without compromising quality or workflow. We offer transparent and scalable pricing models, allowing you to pay for the services that you consume only whenever you want them.

Blog

Latest Insights

Stay Compliant: Review Our Blog for Up-to-Date Insights into Accounting and Regulatory Issues:

Quick Answers

FAQs

- Q1: What is the difference between accounting and bookkeeping?

A: While bookkeeping entails gathering and recording financial transactions, accounting is all about interpreting, analyzing, classifying, and reporting financial data to management and external bodies, such as regulators.

- Q2: How often do you review financial statements?

A: We can review your business’s financial statements quarterly or annually, depending on your service package. However, we provide ongoing services, with our experts a phone call away whenever you need them to address a unique financial situation in your company.

- Q3: Why outsource accounting instead of hiring in-house?

A: Outsourcing accounting services for business saves you from the cost of hiring and retaining a full-time employee. Instead of paying for employee benefits and other tools and office supplies needed to get the job done, you’ll only incur expenses for the service that you need if you outsource.