Knowing When to Submit a 1099 for Your Accountant

A Guide for Business Owners

Not sure when to file a 1099 for your accountant? This guide breaks down deadlines, tips, and penalties to help you stay compliant and stress-free.

Table of Contents

- Capital gains tax shows up when you sell at a profit. If the sale price is higher than what you paid (plus certain costs), the difference can be taxable.

- Time matters because it can change the rate. Assets held one year or less fall under short-term rules, while assets held longer fall under long-term rules, which often have lower rates.

- This tax can quietly change your real return. Even a strong investment gain can look different after taxes, so planning sales and timing can protect your net outcome.

- Home sales and real estate have special rules. A primary residence may qualify for an exclusion if IRS requirements are met, and a 1031 exchange may allow certain investors to defer tax on rental property gains.

- The calculation depends on the cost basis. Your basis is the starting point for the math, so fees and other included costs matter. Better records usually mean cleaner, more accurate reporting.

- There are practical ways to reduce liability. Holding assets longer, using tax-advantaged accounts like IRAs or 401(k)s, and checking the rules before major sales can prevent expensive surprises.

Not so many business owners are thrilled with the tax season. You need to collect and issue all necessary tax forms for your venture as deadlines arrive quickly and non compliance risks loom over you which can be daunting. Among the prevalent forms, yet commonly misunderstood, you’ll handle during tax seasons are the 1099s. This blog guides you on when to submit 1099 after thorough planning. Keep reading to also learn about the consequences of late or incorrect submissions.

Understanding 1099 Forms

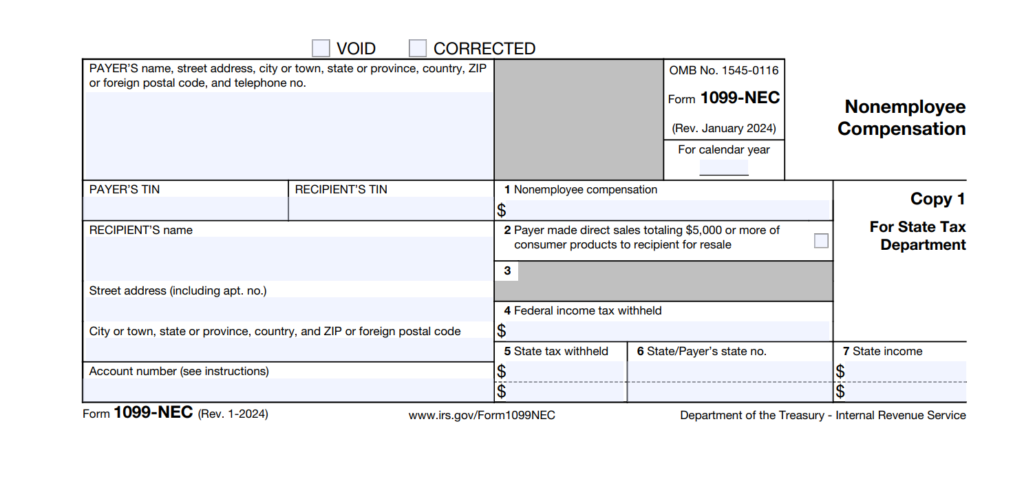

The U.S. Internal Revenue Service (IRS) issues various types of 1099 forms to businesses that generate income and incur certain expenses. Prevalent forms in this category include the 1099-MISC for reporting miscellaneous income and the 1099-NEC, which is designed to cover non-employee compensation. Per IRS guidelines, businesses, self-employed individuals and non-profit organizations must issue 1099 form to any individual or entity that has received at least $600 or more in tax year for services provided.

Tips for Preparing Your 1099

One way to ensure smooth submission of 1099 CPA or other service providers is to keep up-to-date and accurate records throughout the year. These include a well-organized account of remittances to service providers plus their tax identification numbers (TINs) to simply your submissions at the end of the year. At the same time it can help if you liaise with your accountant to stay updated on any regulation changes at the IRS.

Have Questions About 1099 Forms?

Consequences of Late or Incorrect Submission

Submitting incorrect information in your 1099 or failing to file the form completely can result in hefty penalties, including fines ranging from $50 to $270 per form. The exact amount will depend on how late the form was filed. Incorrect CPA 1099 filings can also trigger costly and time-consuming audits, eating up your operating capital and exposing you to regulatory non-compliance risks.

Conclusion

Knowing when to mail your 1099 forms to contractors and filing them electronically with the IRS is a vital tactic for prudent business management as far as tax compliance and other financial regulations are concerned. By wrapping your head around these forms, their submission threshold, and deadlines, you can avoid penalties and unnecessary business interruption by random, unplanned audits. Leverage this guide and seek the counsel of a professional accountant to ensure you get it right from the start.

FAQ

- Q1: Under what circumstances is capital gains tax due?

A: It is usually due after you sell an asset for a profit. A profit means the sale price is higher than your cost basis. If you have not sold, the gain is not usually taxed.

- Q2: What is cost basis, and what should I include in it?

A: Cost basis is what the IRS treats as your starting cost. It is usually the purchase price plus certain fees you paid to buy the asset. Your gain is the sale price minus that total.

- Q3: Can cost basis change after I buy an asset?

A: Yes. For real estate, major upgrades can increase cost basis. Routine repairs usually do not. Save invoices and receipts so you can show why your basis is higher.

- Q4: Why does the one-year holding period matter so much?

A: It changes the category of the gain. One year or less is usually short-term. More than one year is usually long-term. Long-term gains often have lower tax rates.

- Q5: Does reinvesting the money remove the capital gains tax?

A: Not usually. The sale creates the taxable event. Reinvesting does not cancel it. Some real estate rules can delay tax, but only when the transaction follows strict steps.

- Q6: Does the home sale exclusion apply automatically?

A: No. It applies only if the home was your primary residence and you meet IRS ownership and use rules. If you do not qualify, some or all of the gain can be taxable.

- Q7: What is one common mistake people make when calculating capital gains?

A: Mixing up the rate in the math. A 20% rate is 0.20, not 0.02. That simple error can change the tax you report.

- Q8: When is professional help worth it for capital gains tax?

A: If you have several sales, real estate transactions, crypto activity, or exchange rules, it is worth getting advice. A tax professional can confirm the correct treatment and prevent filing mistakes.