How to Calculate QBI: Eligibility, Rules, and Examples

Lower your federal taxes! Discover QBI deduction basics, who qualifies, and how to claim up to 20% off qualified business income.

Table of Contents

Forbes estimates that 9 out of 10 businesses in the U.S. overpay their taxes regardless of whether they are working with a tax professional. This often happens because many entrepreneurs are unaware of the tax deductions they can claim when filing returns. To explore a comprehensive overview of various business tax deductions, refer to our Business Tax Deduction Cheat Sheet.

One such tax break is the qualified business income deduction. So, what is the QBI deduction, and how can it help you lower federal income taxes while remaining compliant? Which rules apply to this tax-saving reform? Here is a quick guide to help you get started.

Key Takeaways

- The QBI deduction can cut taxable income by up to 20%. Section 199A lets many pass-through owners deduct up to 20% of qualified business income. It can also apply to qualified REIT dividends and PTP income.

- Only certain business structures and income types qualify. QBI generally comes from U.S. trade or business income in sole proprietorships, partnerships, S corporations, and many LLCs. It does not come from W-2 wages or most investment income.

- Several common income items are excluded from QBI. Capital gains and losses, dividends, annuities, guaranteed partnership payments, notional principal contract items, and foreign business income typically do not count.

- Taxable income thresholds can reduce the deduction. Once taxable income reaches the IRS phase-out range, the deduction can shrink. Above the range, limits can apply more strictly depending on the business type.

- SSTBs face tighter rules at higher incomes. Fields like law, accounting, consulting, healthcare, finance, athletics, and brokerage services can see the deduction reduced in the phase-out range, and potentially lost above it.

- W-2 wages and business property can cap the result. At higher income levels, the deduction can be limited by payroll and, in some cases, the basis of qualified property. That is why wage levels and major assets can change the final number.

What Is the QBI Deduction?

Also known as Section 199A deduction, QBI deduction is a tax break that enables self-employed individuals and small business owners to deduct up to 20% of their QBI when filing tax returns. It also allows taxpayers to deduct up to 20% of qualified REIT dividends and publicly traded partnership (PTP) income. The Tax Cuts and Jobs Act (TCJA) introduced the tax reform measure in 2017 and is set to expire at the end of 2025 unless extended by Congress.

Eligibility Criteria for QBI Deduction

Taxpayers must meet certain eligibility criteria to qualify for a QBI deduction. This includes earning Qualified Business Income from eligible trades or businesses and meeting certain taxable income thresholds in the year of filing.

Qualified Business Income (QBI)

QBI constitutes the net income earned from a qualified trade or business operation within the U.S. This might include profits earned from pass-through businesses or self-employment activities, such as freelancing, consulting and renting real estate properties like residential homes and commercial buildings.

However, it’s important to note that the IRS excludes certain types of income from a QBI calculation because they don’t meet the eligibility criteria provided in the tax code. These include profits from investment items such as capital gains or losses, annuities, guaranteed payments from a partnership, and income, loss or deductions from notional principal contracts. Additionally, any income linked to business operations outside the U.S. does not qualify for QBI deduction.

Qualified Trades or Businesses

QBI deduction calculation applies to trades or businesses that qualify as pass-through entities. These include entities structured as partnerships, sole proprietorships, S corporations, and single-member limited liability companies. Examples of businesses under this category are manufacturing companies, retail stores, technology firms and service providers not classified as Specified Service Trades or Businesses (SSTBs). More about Entity Selection.

SSTBs are entities whose main asset is the skill or reputation of the underlying owners or employees. They are often in service-based industries, such as healthcare, law, accounting, consulting, financial services, athletics and brokerage services. Income derived from these businesses can be subject to certain QBI deduction limitations under the TCJA.

Taxable Income Thresholds

The IRS has set various income limits and phase-out ranges for higher-income earners seeking to claim Section 199A deductions. The income limits for this tax break in the 2024 tax year are $191,950 or less for single filers and $383,900 or less for individuals filing jointly. These figures are slightly higher than the limits for the 2023 tax year, which included 182,100 or less for single filers and $364,200 or less for joint filers.

It’s worth noting that the phase-out ranges for eligible QBI deductions change with each tax year. In the 2024 tax year, the IRS will phase out Section 199A deductions for single filers earning between $191,951 to $241,950 and $383,901 to $483,900 for people filing jointly.

Understanding the distinctions between business structures is crucial, as QBI deductions apply differently to various entities. For more information, see our article on Tax Differences Between C Corporations and S Corporations.

Have Questions about QBI Calculation?

How to Calculate QBI

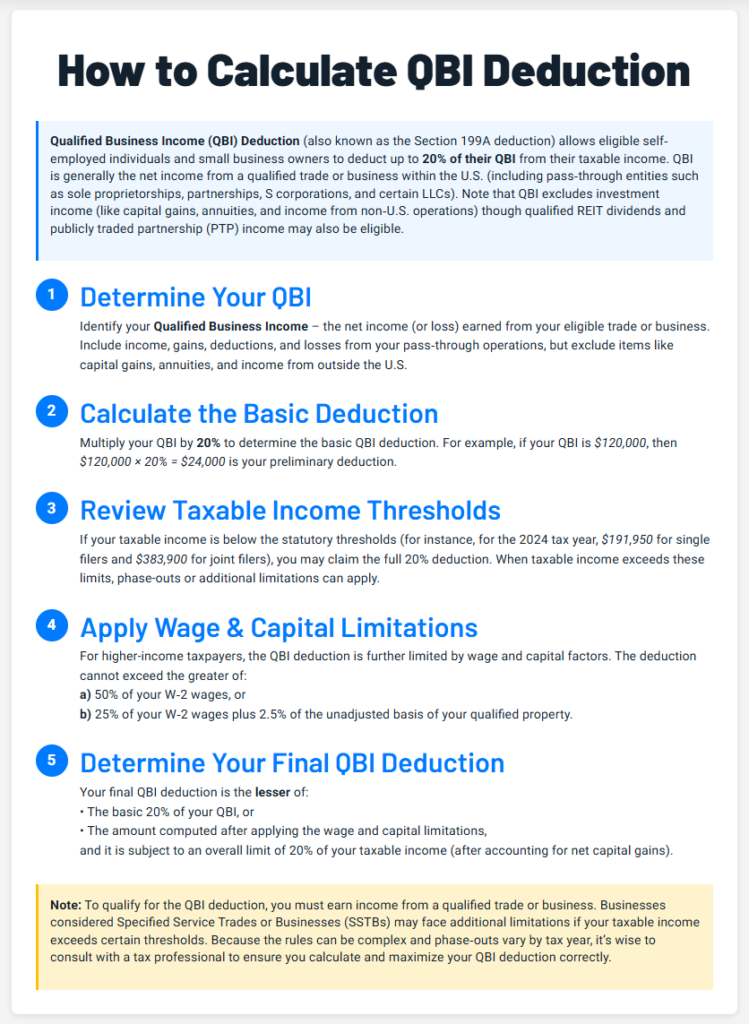

While QBI calculation can be complex or even require the involvement of professional tax preparers, understanding how the concept works can help you maximize this tax benefit and save money in terms of reduced liabilities. With this in mind, here is how to calculate qualified business income in your unique scenario:

1. Basic QBI Calculation

Small business owners and self-employed individuals can calculate QBI deduction by multiplying their qualified business income by 20%. In this case, qualified business income encompasses the net amount of income, gain, deduction and loss from the underlying qualified business or trade.

To put it into perspective, consider this hypothetical case involving Nelly, who runs a business dealing with a wide range of beauty and cosmetic products. Nelly’s net profit from the business (her QBI) for the tax year 2024 is $120,000.

Following the basic steps of how to calculate QBI, Nelly will multiply the $120,000 by 20% to get an eligible deduction of $24,000. The IRS will allow Nelly to claim this amount if her taxable income is below $191,950, regardless of whether her business operates as an SSTB or not.

2. Adjustments for Taxable Income

As implied in Nelly’s case, a taxpayer’s overall taxable income can pose certain limitations for a Section 199A deduction. As a business owner’s taxable income increases, the taxpayer’s QBI deduction calculation may be adjusted or phased out entirely. For example, Nelly may receive a partial deduction if her business falls in a specified phase-out range above the income threshold of $191,950. However, she might be ineligible to claim the deduction if the business’ income falls above this threshold.

3. Wage and Capital Limitations

Other factors to consider when learning how to calculate QBI are wage and capital limitations. In this case, there are two limitations, with the first one requiring that the QBI deduction don’t exceed 50% of the W-2 wage expenses incurred by the business or 25% of W-2 wages plus 2.5% of the unadjusted basis of qualified property.

The second limitation is the 25% wage and 2.5% property basis limitation. It targets businesses with higher income levels to ensure their owners don’t benefit unfairly from the QBI tax reform.

Proper Business Structuring

Start by considering your unique scenario to evaluate whether it’s suitable to restructure your business and position it to qualify for QBI deduction. For instance, tax experts recommend switching to a pass-through entity whose profits are taxed through the owners or partners under the individual income tax rather than corporate income tax. A pass-through business can include an LLC, a sole proprietorship, a partnership or an S-corporation.

At the same time, you can adjust your income levels to maximize Section 199A deductions. By employing strategies like deferring income or accelerating other tax credits and deductions, you can lower your overall taxable income and increase your eligibility for the maximum QBI deduction in your unique circumstance.

Managing Wage and Property Allocations

Another strategy for maximizing qualified business income deduction is by managing employee wages and property allocations prudently.

If your entity faces wage limitations, you might want to pay sufficient wages to employees to maximize the deduction. Likewise, you can also invest in business assets or accelerate depreciation schedules for the underlying property’s components to help boost the deduction amount, ultimately lowering your taxable income. This could allow you to claim a higher Section 1099A deduction.

Tax Planning Techniques

While it might be tempting to handle your tax matters personally, it’s recommended to consult with a tax specialist, especially if you want to maximize eligible deductions like QBI. Experts like tax preparers can help you formulate tax planning strategies to minimize your overall liabilities while ensuring compliance with federal, state or local tax provisions.

Prevalent tax planning techniques that may apply to individual unique circumstances include leveraging retirement accounts to lower the overall taxable income or accelerating business expenses to claim other eligible deductions.

Proactive tax planning can offer significant advantages in maximizing QBI deductions. Learn more in our article on Tax Planning: 6 Benefits for Your Business

Benefits of Understanding QBI Calculation

Understanding how to calculate QBI and the implications of this tax reform can result in various benefits at both individual and business levels. These include:

Increased Tax Savings

QBI calculation can help you claim a deduction of up to 20% of your qualified business income. In addition to reducing your taxable income, this strategy can lower the overall amount of taxes you owe to the IRS, ultimately freeing more resources for reinvestment into the business or acquisition of other cash-generating assets, such as real estate properties. Moreover, by lowering your liabilities year after year, you can accumulate more wealth to realize ultimate financial independence even at retirement.

Improved Cash Flow for Businesses

Besides increasing tax savings, using QBI deductions can help your business improve cash flow and unlock additional growth opportunities. For instance, claiming the maximum qualified business income deduction means extra capital to expand operations, lease new equipment, hire additional staff or branch out into new product lines and services.

Conclusion

QBI deduction is a game-changing tax reform that can help small business owners and self-employed individuals deduct up to 20% of their qualified business income when filing returns. Knowing how to calculate QBI can also improve cash flow at both business and individual levels, positioning the underlying taxpayer to save as much as they earn and achieve financial goals. Leverage this guide to get started with strategy and consult professionals like tax preparation specialists to learn how you can maximize it to your advantage. For personalized assistance, explore our Tax Advisory and Preparation Services.

FAQ

- Q1: Who can claim the QBI deduction?

A: It generally applies to pass-through income, such as sole proprietors, partnerships, S corporations, and single-member LLCs. You also need qualified business income and to stay within the IRS income limits for your filing year.

- Q2: What income does not count as QBI?

A: QBI usually excludes capital gains and losses, dividends, annuities, guaranteed partnership payments, notional principal contract items, and income tied to business activity outside the U.S

- Q3: Do rentals qualify for QBI?

A: Some rental real estate income may qualify if it is treated as a trade or business and reported as qualified income. The facts matter, so recordkeeping and how the activity is run can affect eligibility.

- Q4: Why do SSTBs matter for QBI?

A: Specified Service Trades or Businesses face added limits at higher income levels. If taxable income enters the phase-out range, the deduction can shrink, and above it, an SSTB may lose the deduction.

- Q5: Can a high taxable income reduce the deduction even with strong QBI?

A: Yes. Once taxable income rises into the phase-out range, the QBI deduction may be reduced. Above the upper end of the range, limits can fully apply and may eliminate the deduction in some cases.

- Q6: What are the wage and property limits in simple terms?

A: At higher incomes, the deduction may be capped using W-2 wages and, in some cases, the cost basis of qualified property. This is why payroll levels and major business assets can affect the result.

- Q7: What is a practical way to improve QBI results?

A: Planning can help. Common levers include entity structure, timing income and expenses to manage taxable income, and keeping wage and asset records clean so the calculation is supported.

- Q8: Why should QBI be reviewed each year?

A: Income thresholds and phase-out ranges change by tax year, and business facts shift. A yearly review helps confirm eligibility, apply the right limits, and avoid missed deductions or reporting issues.