Knowledge Base

In addition to providing proactive accounting and tax advisory services to our clients, Evans Sternau CPA aims to educate.

How are my oil and gas investments taxed?

Evans Sternau CPA is a CPA in Houston and provides tax planning and tax advisory services to help you navigate the the tax on oil and gas investments.

CPA in Houston Provides Insight about Secure 2.0 Act

Evans Sternau CPA is a CPA in Houston and provides tax planning and tax advisory services to help you navigate the the Secure 2.0 Act.

How Evans Sternau CPA Can Make Your Tax Season Trouble-Free

Tax season is here, and there’s nothing like the stress of filing your taxes to make you dread April 18th. Fortunately, the experienced accountants at Evans Sternau CPA can help make your tax season trouble-free with our comprehensive tax advisory and preparation services.

Finding Relief During a Recession: How Evans Sternau CPA Can Help

When it comes to financial planning, a recession can be extremely stressful and difficult. With rising unemployment and cost of living expenses, it can be hard to find relief. Fortunately, Evans Sternau CPA can provide assistance. With our range of services, including tax preparation, financial planning, and business consulting, we help individuals and businesses alike navigate the difficult economic waters of a recession.

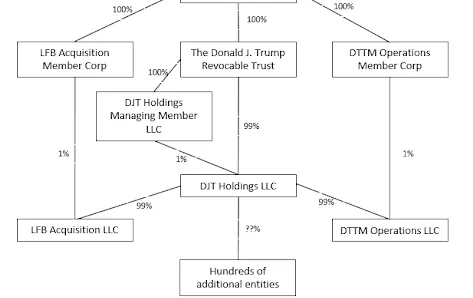

Tax Pro with Experience Working With Billionaires Weighs in on Trump Tax Return

On Friday December 30, 2022 the House Ways and Means Committee released six years of former President Donald Trump’s tax returns. The release of the tax returns offers a rare opportunity to gain insight into tax strategies used by the most wealthy people in the United States.

Our Services: What Evans Sternau CPA Can Do for You

At Evans Sternau CPA, we strive to provide our clients with a comprehensive suite of accounting services tailored to their individual needs. With our host of tax advisory, accounting and compliance, and other services, our team of experienced professionals is here to help no matter what tax services you require.

Tips for Minimizing Tax Liability for High-Net Worth Individuals

Taxes matter for everyone, regardless of income level. Luckily, high-net worth individuals have access to unique opportunities and strategies that can help minimize their tax liability and maximize their wealth.